इस लेख में हम आपको अटल पेंशन योजना (APY) के बारे में पूरी जानकारी देंगे। आप जानेंगे:

- अटल पेंशन योजना का परिचय और उद्देश्य।

- इस योजना की शुरुआत कब और किसने की।

- यह योजना किन लोगों के लिए है और कैसे यह असंगठित क्षेत्र के श्रमिकों को पेंशन का लाभ देती है।

- योजना के लाभ, पात्रता, और योगदान प्रक्रिया।

अगर आप अपनी वृद्धावस्था को सुरक्षित बनाना चाहते हैं और भविष्य में एक नियमित आय की तलाश कर रहे हैं, तो यह योजना आपके लिए है। आइए, विस्तार से जानते हैं इस योजना के बारे में।

अटल पेंशन योजना (APY) क्या है?

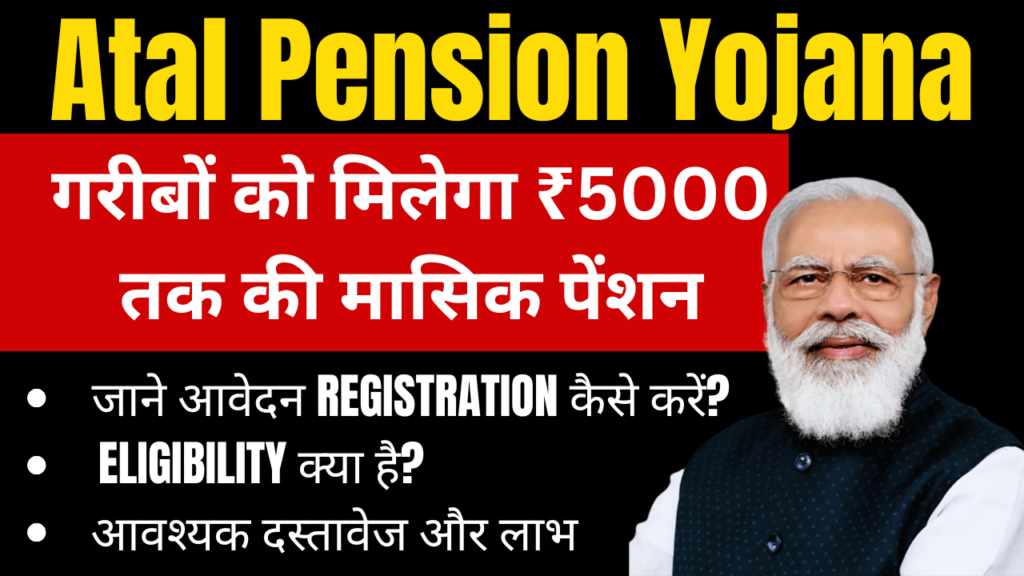

अटल पेंशन योजना (Atal Pension Yojana) भारत सरकार द्वारा 9 मई 2015 को लॉन्च की गई थी। इसका मुख्य उद्देश्य असंगठित क्षेत्र के श्रमिकों को वृद्धावस्था में आर्थिक सुरक्षा देना है। प्रधानमंत्री नरेंद्र मोदी ने इस योजना की शुरुआत की थी, ताकि असंगठित क्षेत्र में काम करने वाले श्रमिकों को पेंशन लाभ (Pension Benefit) मिल सके।

यह योजना विशेष रूप से उन लोगों के लिए है, जो आयकर दाता नहीं हैं और अपनी वृद्धावस्था के लिए कोई पेंशन योजना नहीं रखते हैं। इसके तहत, सरकार असंगठित क्षेत्र के श्रमिकों को पेंशन की सुविधा प्रदान करती है, जिससे वे अपने जीवन के आखिरी समय में वित्तीय रूप से सुरक्षित रह सकें।

अटल पेंशन योजना का उद्देश्य और फोकस

अटल पेंशन योजना का मुख्य उद्देश्य दीर्घायु के जोखिम (Longevity Risks) को कम करना है और असंगठित क्षेत्र के श्रमिकों को स्वैच्छिक रूप से अपनी भविष्य की बचत के लिए प्रोत्साहित करना है। इस योजना का फोकस गरीब, वंचित और असंगठित क्षेत्र के श्रमिकों पर है।

यह योजना ऐसे लोगों को पेंशन प्रदान करती है जो अन्य सरकारी पेंशन योजनाओं का हिस्सा नहीं हैं और जिनके पास पर्याप्त वित्तीय संसाधन नहीं हैं।

अटल पेंशन योजना की विशेषताएं

| पेंशन राशि: | इस योजना के तहत आप हर महीने ₹1,000 से ₹5,000 तक की पेंशन प्राप्त कर सकते हैं, जो आपकी योगदान राशि और चुने गए पेंशन विकल्प पर निर्भर करती है। |

|---|---|

| आयु सीमा: | योजना में शामिल होने के लिए आपकी आयु 18 से 40 वर्ष के बीच होनी चाहिए। |

| आयकर दाता नहीं होना चाहिए: | इस योजना का लाभ सिर्फ उन्हीं लोगों को मिलेगा जो आयकर दाता (Income Tax-Payee) नहीं हैं। |

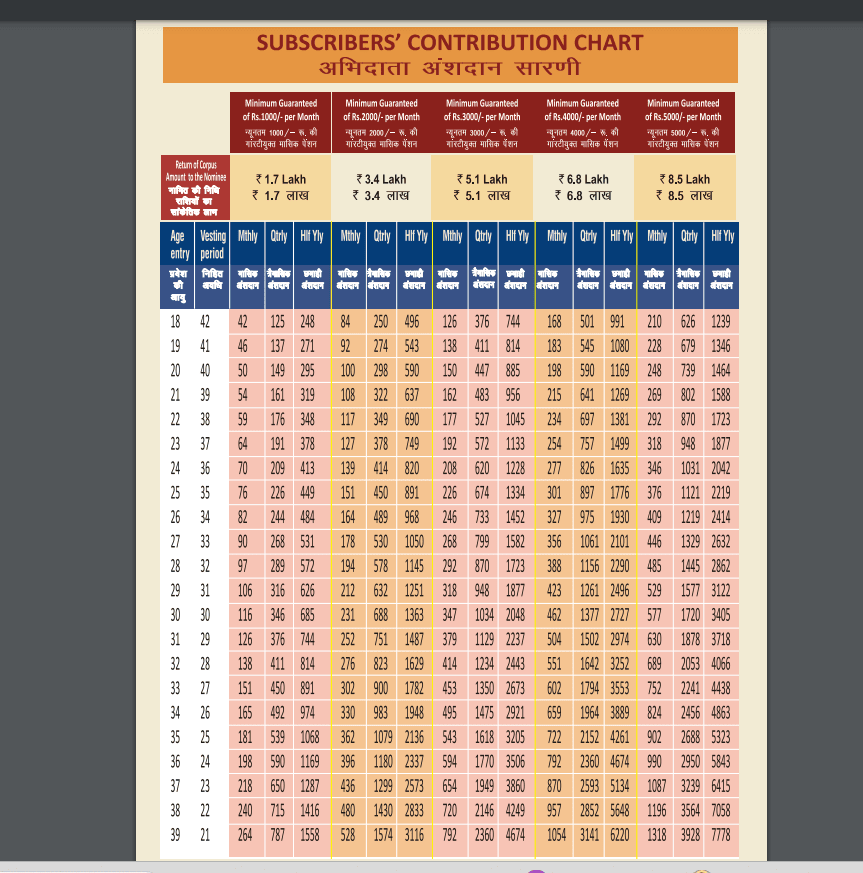

Atal Pension Yojana Chart List

अटल पेंशन योजना में पंजीकरण के लिए आपको एक निर्धारित योगदान राशि का भुगतान करना होता है। आपके द्वारा चुने गए पेंशन राशि के आधार पर आपकी मासिक या वार्षिक योगदान राशि तय होती है। अधिक जानकारी और चार्ट के लिए आप यहां क्लिक करें।

अटल पेंशन योजना पर शुल्क और ओवरड्यू ब्याज

इस योजना में निर्धारित योगदान राशि का भुगतान समय पर नहीं करने पर आपको शुल्क और ओवरड्यू ब्याज देना पड़ सकता है। यह शुल्क और ब्याज की दरें PFRDA द्वारा समय-समय पर निर्धारित की जाती हैं।

शिकायत निवारण: Raising Grievance under APY

अगर आपको योजना से संबंधित कोई भी समस्या है, तो आप बिना किसी शुल्क के अपनी शिकायत दर्ज कर सकते हैं। आप यहां क्लिक करके अपनी शिकायत दर्ज कर सकते हैं। इसके बाद आपको एक टोकन नंबर दिया जाएगा, जिससे आप अपनी शिकायत की स्थिति चेक कर सकते हैं।

इस प्रकार, अटल पेंशन योजना एक महत्वपूर्ण और लाभकारी योजना है, जो असंगठित क्षेत्र के श्रमिकों को वित्तीय सुरक्षा प्रदान करती है।

अटल पेंशन योजना के लाभ और हानि

अटल पेंशन योजना (APY) एक सरकारी पेंशन योजना है, जो असंगठित क्षेत्र के श्रमिकों को वृद्धावस्था में वित्तीय सुरक्षा प्रदान करने के उद्देश्य से शुरू की गई थी। इस योजना का लक्ष्य उन लोगों को पेंशन लाभ देना है, जो नियमित रूप से पेंशन योजना का हिस्सा नहीं बन पाते और अपनी भविष्य की आर्थिक सुरक्षा के लिए बचत नहीं कर पाते। आइए जानते हैं इस योजना के कुछ प्रमुख लाभ और हानियों के बारे में।

Benefits of Atal Pension Yojana

| लाभ | विवरण |

|---|---|

| गारंटीकृत न्यूनतम पेंशन | इस योजना के तहत, 60 वर्ष की आयु के बाद सदस्य को ₹1,000 से ₹5,000 प्रति माह की गारंटीकृत पेंशन मिलेगी। यह राशि सदस्य द्वारा चुने गए विकल्प के आधार पर होगी। |

| पति/पत्नी को पेंशन | यदि योजना में पंजीकरण करने वाले सदस्य की मृत्यु 60 वर्ष से पहले हो जाती है, तो उनके जीवनसाथी को वही पेंशन मिलेगी जो सदस्य को मिल रही थी, और यह राशि जीवनसाथी की मृत्यु तक जारी रहेगी। |

| नॉमिनी को पेंशन धनराशि की वापसी | जब सदस्य और उनके जीवनसाथी दोनों की मृत्यु हो जाती है, तो पेंशन योजना में जमा राशि उनके नॉमिनी को वापस की जाती है। यह राशि उनके द्वारा जमा किए गए पेंशन धनराशि के बराबर होती है। |

| कर लाभ (Tax Benefit) | इस योजना में योगदान करने पर आपको धारा 80CCD(1) के तहत टैक्स में छूट मिलती है, जो योजना को और अधिक आकर्षक बनाती है। |

| स्वैच्छिक निकासी (Voluntary Exit) | 60 वर्ष से पहले इस योजना से बाहर निकलने पर सदस्य को अपनी जमा राशि और उस पर अर्जित ब्याज वापस मिलती है। हालांकि, यदि सदस्य ने सरकार से सह-योगदान प्राप्त किया हो, तो वे यह राशि और ब्याज नहीं प्राप्त कर सकते। |

| मृत्यु से पहले पेंशन लाभ | अगर सदस्य 60 वर्ष से पहले मृत्यु हो जाते हैं, तो उनके जीवनसाथी को दो विकल्प दिए जाते हैं। 1. जीवनसाथी को पेंशन मिलती है, जो मूल सदस्य को मिल रही थी। 2. पूरी जमा राशि जीवनसाथी या नॉमिनी को लौटा दी जाती है। |

उदाहरण

मान लीजिए, हिमांशु ग्रेवाल (28 साल) ने Atal Pension Scheme में ₹1,000 प्रति माह पेंशन के लिए रजिस्टर कराया। उन्होंने पेंशन के लिए ₹1,000 प्रति माह योगदान देना शुरू किया और उनका लक्ष्य 60 वर्ष की आयु तक इस योजना से लाभ उठाने का है। अब जब हिमांशु 60 वर्ष के हो जाते हैं, तो उन्हें हर महीने ₹1,000 पेंशन मिलनी शुरू हो जाएगी।

लेकिन, अगर हिमांशु की 60 वर्ष से पहले मृत्यु हो जाती है, तो उनकी पत्नी को वही ₹1,000 प्रति माह पेंशन मिलेगी। और अगर हिमांशु और उनकी पत्नी दोनों की मृत्यु हो जाती है, तो उनका नॉमिनी (जैसे कि उनका बेटा) पूरी जमा पेंशन राशि प्राप्त करेगा। इसके अलावा, हिमांशु के योगदान पर टैक्स लाभ भी मिलेगा, जिससे उन्हें अपनी टैक्स लाइबिलिटी में छूट मिलेगी।

अटल पेंशन योजना के हानि

1. 60 वर्ष से पहले निकासी पर प्रतिबंध (Restrictions on Withdrawal Before 60): अगर सदस्य 60 वर्ष से पहले इस योजना से बाहर निकलते हैं, तो उन्हें केवल अपनी जमा राशि और उस पर अर्जित ब्याज प्राप्त होता है। साथ ही, जो सदस्य 31 मार्च 2016 से पहले योजना में शामिल हुए थे और उन्होंने सरकार से सह-योगदान प्राप्त किया था, उन्हें सरकार द्वारा दिया गया योगदान और उस पर अर्जित ब्याज वापस नहीं मिलता।

2. मृत्यु से पहले पेंशन का सीमित लाभ (Limited Pension Benefit Before Death): अगर किसी सदस्य की मृत्यु 60 वर्ष से पहले हो जाती है, तो उनके जीवनसाथी को दो विकल्प मिलते हैं:

- विकल्प 1: जीवनसाथी को वही पेंशन मिलती है जो सदस्य को मिल रही थी, और यह पेंशन जीवनसाथी की मृत्यु तक जारी रहती है।

- विकल्प 2: पूरे पेंशन कोष को जीवनसाथी या नॉमिनी को लौटा दिया जाता है।

इसमें पेंशन लाभ केवल एक व्यक्ति (सदस्य या जीवनसाथी) तक ही सीमित होता है।

Atal Pension Yojana Eligibility

| विवरण | आयु सीमा | सदस्य का योगदान | पेंशन प्राप्ति की आयु |

|---|---|---|---|

| जॉइनिंग की आयु | 18 से 40 वर्ष | सदस्य का योगदान ऑटो-डेबिट के माध्यम से होगा | 60 वर्ष |

| पेंशन प्राप्ति की आयु | मासिक, तिमाही या अर्ध-वार्षिक रूप में योगदान | 60 वर्ष के बाद | |

| सदस्य का योगदान अवधि | 18 वर्ष से 60 वर्ष तक | स्वचालित रूप से नियमित योगदान | जीवन भर पेंशन प्राप्त होगी |

Exclusions

1 अक्टूबर 2022 से, कोई भी नागरिक जो आयकरदाता है या रहा है, वह अटल पेंशन योजना (APY) में शामिल होने के योग्य नहीं होगा। इसका मतलब यह है कि यदि आपने कभी आयकर का भुगतान किया है, तो आप इस योजना का लाभ नहीं उठा सकते।

अटल पेंशन योजना का आवेदन कैसे करें?

अटल पेंशन योजना ऑनलाइन अप्लाई करने के लिए नीचे दिए स्टेप का पालन करें।

प्रक्रिया 1

- आप नेट बैंकिंग के माध्यम से अटल पेंशन योजना (APY) खाता ऑनलाइन खोल सकते हैं।

- सबसे पहले, अपने इंटरनेट बैंकिंग खाते में लॉगिन करें और डैशबोर्ड पर APY सर्च करें।

- फिर, आपको बुनियादी जानकारी और नॉमिनी जानकारी भरनी होगी।

- फिर, आपको अपने खाते से पैसे ऑटोमेटिक कटने के लिए सहमति देनी होगी और फिर आवेदन सबमिट करना होगा।

प्रक्रिया 2

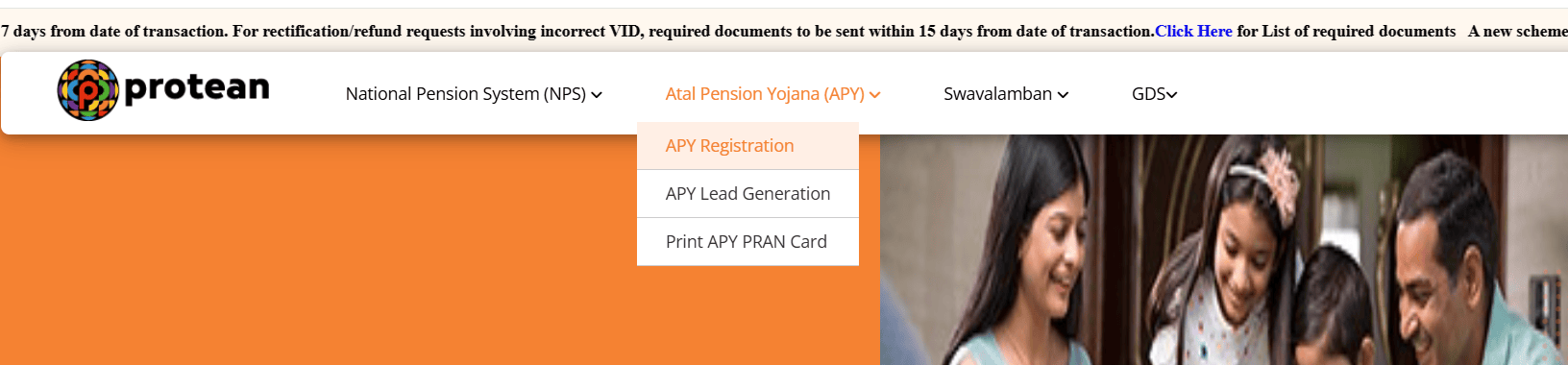

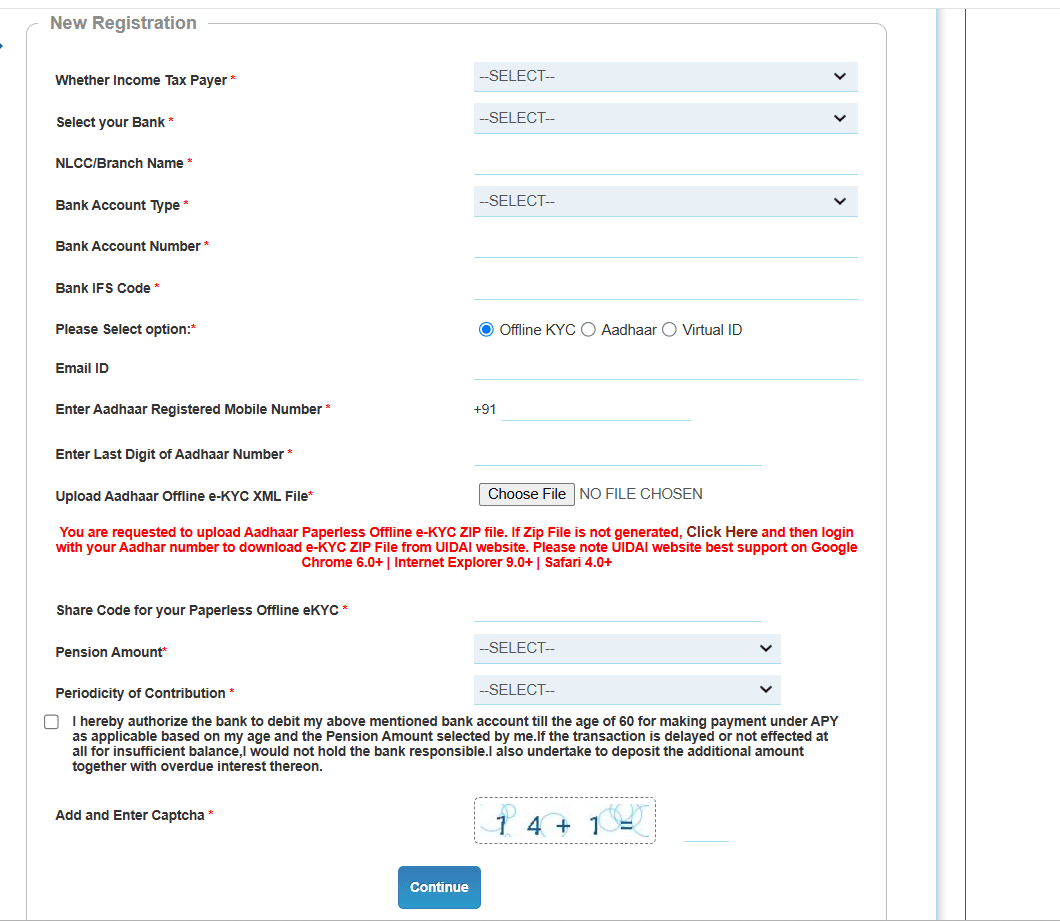

- वेबसाइट पर जाएं: https://enps.nsdl.com/eNPS/NationalPensionSystem.html और “अटल पेंशन योजना” चुनें।

- फिर “APY Registration” विकल्प पर क्लिक करें।

फॉर्म में जरूरी जानकारी भरें और KYC प्रक्रिया पूरी करने के लिए तीन में से कोई एक तरीका चुनें।

- ऑफलाइन KYC: इसमें आपको आधार का XML फ़ाइल अपलोड करना होता है।

- आधार KYC: इसमें OTP के जरिए आधार से जुड़े मोबाइल नंबर पर पुष्टि होती है।

- वर्चुअल ID KYC: इसमें आधार वर्चुअल ID से KYC की प्रक्रिया पूरी होती है।

- बुनियादी जानकारी भरने के बाद एक स्वीकृति संख्या मिलेगी।

- इसके बाद, आपको अपनी व्यक्तिगत जानकारी भरनी होगी और 60 साल के बाद कितनी पेंशन चाहेंगे, यह चुनना होगा।

- आपको योजना के लिए योगदान करने की आवृत्ति भी तय करनी होगी।

- फिर, आपको नॉमिनी की जानकारी भरनी होगी और बाद में eSign के लिए NSDL वेबसाइट पर भेजा जाएगा।

- आधार OTP से पहचान होने के बाद आपका पंजीकरण सफलतापूर्वक पूरा हो जाएगा।

- आप ई-APY पोर्टल या बैंक की वेबसाइट से भी डिजिटल रूप से पंजीकरण कर सकते हैं।

ऑफलाइन आवेदन प्रक्रिया

आप अपने नजदीकी बैंक शाखा या पोस्ट ऑफिस में जाकर अपना आवेदन पत्र जमा कर सकते हैं। यहां आपको केवल अटल पेंशन योजना पंजीकरण फॉर्म भरकर अपने बचत खाता विवरण देने होंगे।

हेल्पलाइन नंबर

- अटल पेंशन योजना के लिए टोल-फ्री हेल्पलाइन नंबर है: 1800-110-069

इस प्रक्रिया को पूरा करने के बाद, आप अटल पेंशन योजना में सफलतापूर्वक पंजीकरण कर सकते हैं और अपनी पेंशन योजना का लाभ उठा सकते हैं।

आवश्यक दस्तावेज़

KYC (Know Your Customer) जानकारी सीधे आपके सक्रिय बैंक या पोस्ट ऑफिस बचत खाते से ली जाती है। इसलिए, आपको अपने खाते से संबंधित सभी जानकारी सही और अपडेटेड रखनी होगी।

Atal Pension Yojana Scheme FAQ (Frequently Asked Questions)

डिस्क्लेमर:

यह लेख केवल जानकारी प्रदान करने के उद्देश्य से लिखा गया है। इस योजना से संबंधित सभी विवरण और नियम सरकार द्वारा समय-समय पर बदले जा सकते हैं। उपयोगकर्ता से अनुरोध है कि वे अधिकृत सरकारी पोर्टल से जानकारी सत्यापित करें। इस लेख में दी गई जानकारी के आधार पर कोई निर्णय लेने से पहले अपनी समझ और परिस्थितियों का विचार करें। लेखक और वेबसाइट किसी भी प्रकार की त्रुटि या जानकारी में बदलाव के लिए उत्तरदायी नहीं होंगे।